CAT STRATEGIC METALS SECURES PRIME MINERAL EXPLORATION GROUND IN NEVADA’S PROLIFIC CARLIN TREND DISTRICT

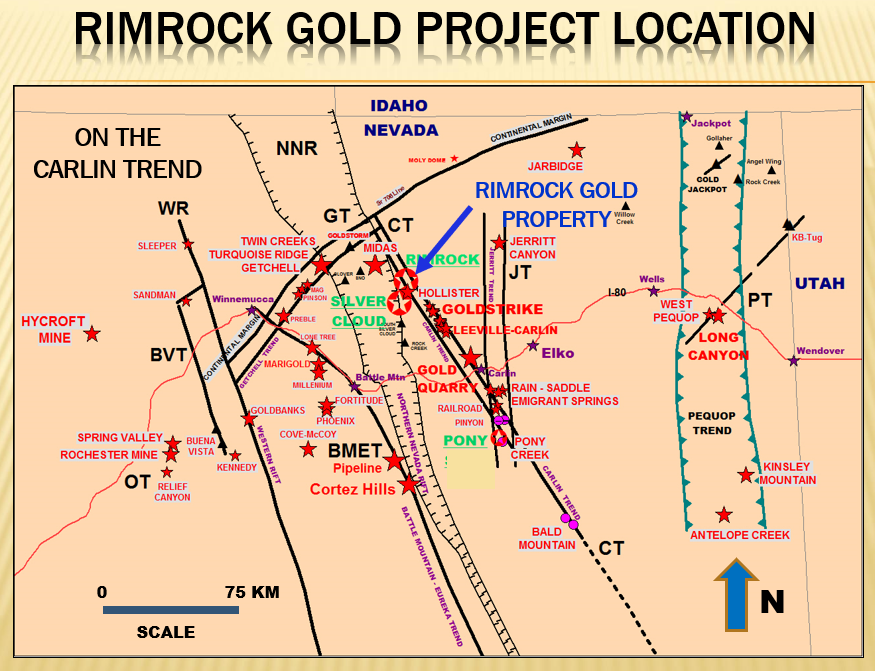

Vancouver, B.C. November 6, 2020 – CAT Strategic Metals Corporation (CSE: CAT)(FRA:8CH) (“CAT” or the “Company”) announces that it has acquired an earn-in and joint venture agreement (the “Agreement”) pursuant to an arm’s length transaction with a private company (the “Vendor”) dated November 2, 2020. to acquire up to an 80% undivided ownership in the Rimrock Gold mineral property (“Rimrock”). Rimrock is comprised of ~1,663 acres adjoining, and immediately north of, Hecla Mining Co.’s Hollister Mine; a gold-silver property, in an area hosting two of Nevada’s largest gold belts, the Midas and Carlin Trends, approximately 77 km (46 mi) Northwest of Elko, Nevada.

The Rimrock Gold Property

The Rimrock Gold mineral property is a low-sulfidation and Carlin-style gold-silver prospect in the heart of the main gold mining belts of northeastern Nevada. Rimrock comprises 81 unpatented lode mining claims (1663 acres; 673 hectares) located in Elko County, Nevada, situated 8 Km northwest of the Hollister gold-silver mine of Hecla Mining, and 16 Km southeast of Hecla’s Midas gold-silver mine. The Hollister Mine had production and reported reserves of approximately 2 million ounces of high-grade gold grading in excess of 1 ounce per ton gold, situated below an old mercury mine. The Midas mine had mine production and mineable reserves of 3 million ounces of high-grade gold and 25 million ounces of silver, in a setting very similar to Rimrock, along the Northern Nevada Rift volcanic belt. Rimrock also lies directly within the Carlin Trend, which extends through the property, northwest of the Goldstrike-Carlin-Leeville mines complex of Nevada Gold Mines LLC (Barrick and Newmont). The center of the property lies 77 km northwest of the major mining and drilling center of Elko

Rimrock is a multi-target gold-silver property, that also has an overlying large-scale deposit of Bentonite in the central part of the property that is exposed at surface

which requires further evaluation. Rimrock also shows immediate potential for a Midas-Hollister-style epithermal gold-silver mine, as well as the potential for a deeper Carlin-style, sediment hosted gold deposit. This property is interpreted to have four or more Midas-type feeder control faults for high grade gold mineralization along the Midas-Hollister gold trend present on the property.

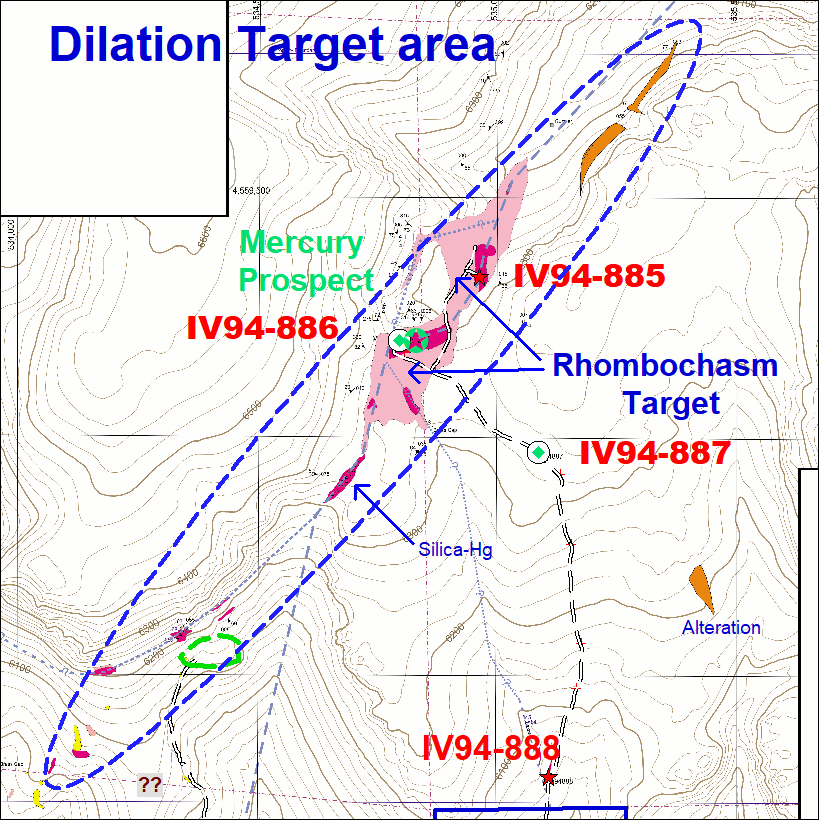

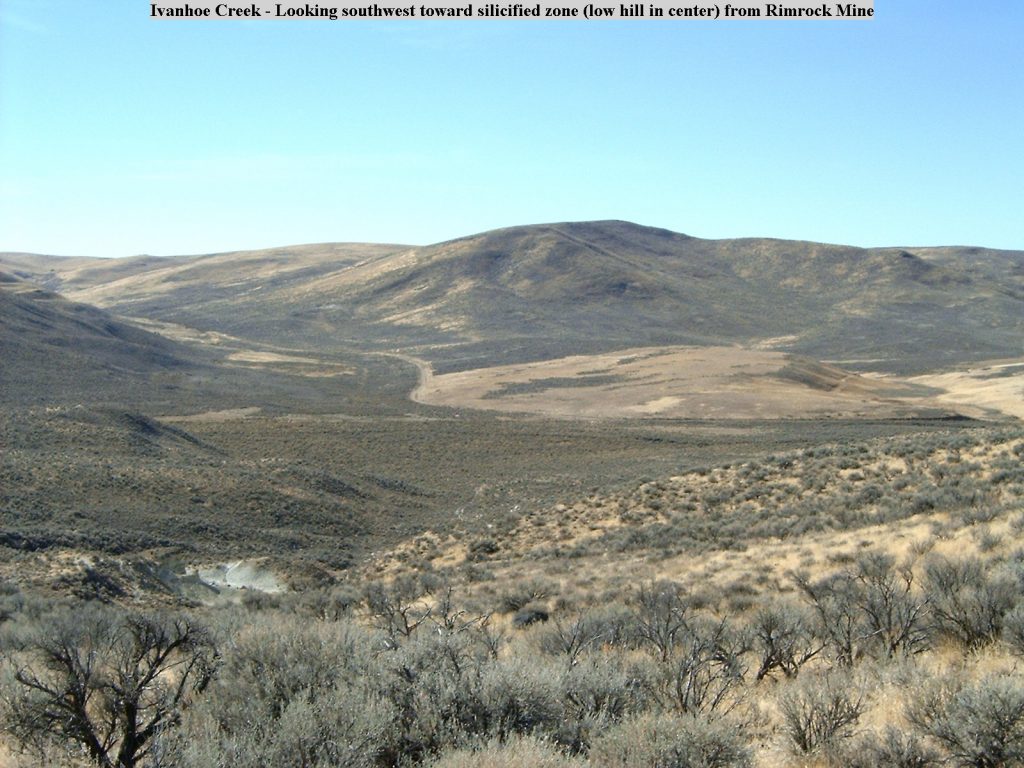

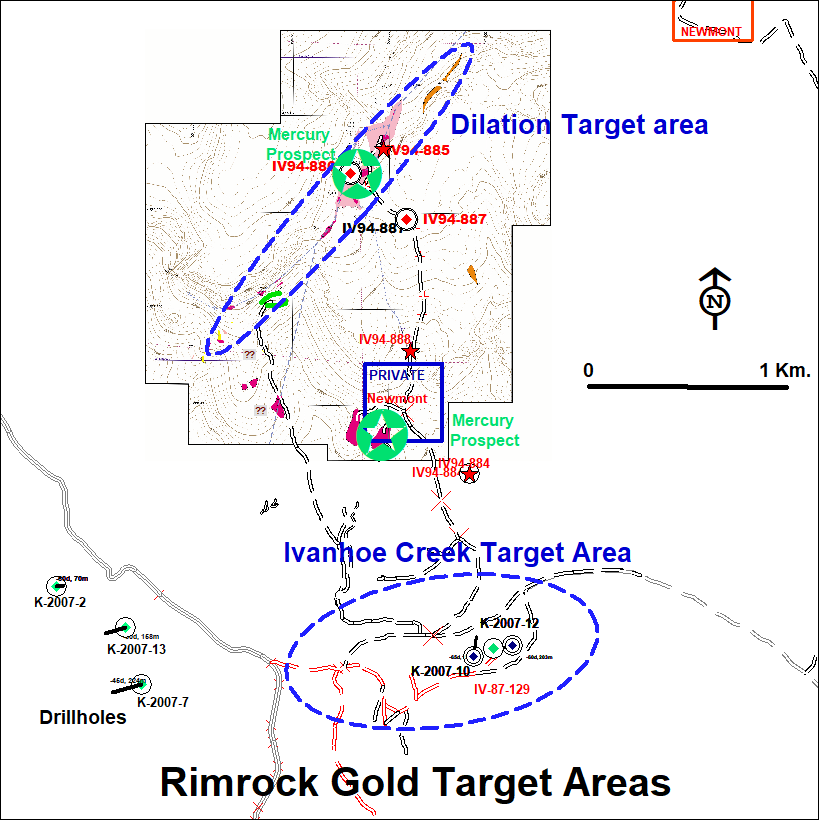

The Rimrock prospect area has two main Au-Ag ore targets

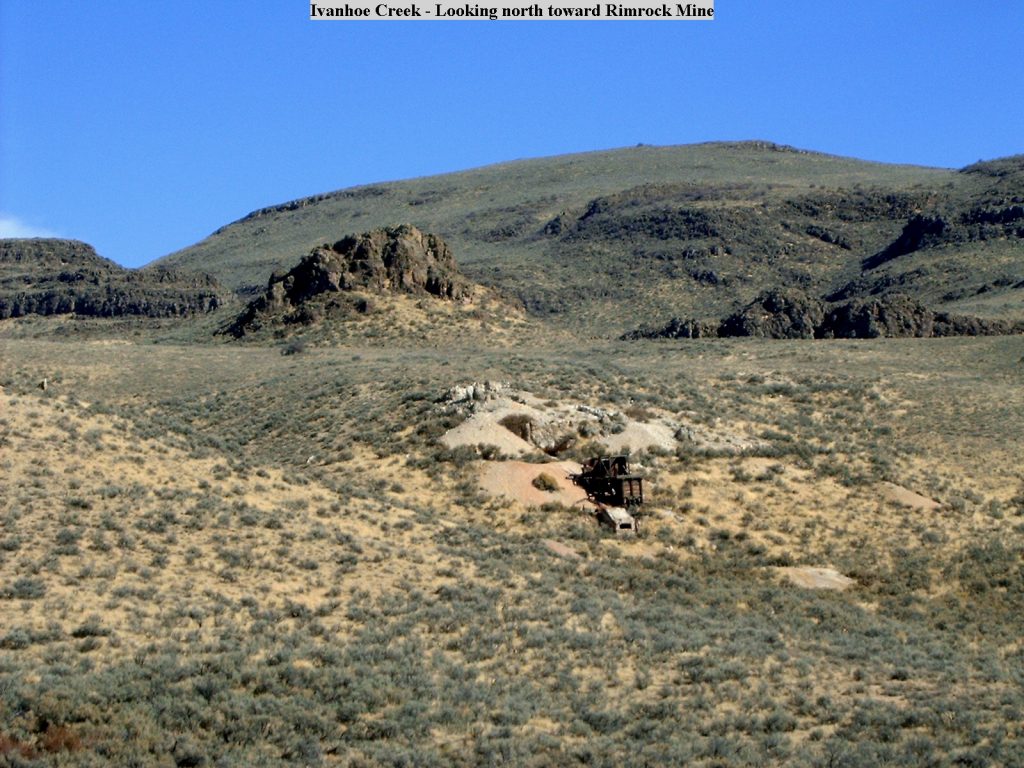

the Dilation zone in the northern part of the property, and the Ivanhoe Creek target in the southern part. Several old mercury mines are present in the area, with one situated directly on top of the main “Rhombochasm” gold ore target along the Dilation zone. It lies at a major fault dilation intersection in the Midas gold trend. These gold-silver targets have never been properly drill tested for Midas-Hollister style gold-silver mineralization, and not deep enough to test the Carlin-style targets present.

Several shallow holes were drilled into the Dilation target area by Newmont Mining in 1994, in search of disseminated open-pitable gold mineralization, and one hole was drilled in 1988 into Ivanhoe Creek by Touchstone Resources. None of the drill holes appear to have been deep enough to test the targets properly.

The best Midas-style gold target at Dilation is named “Rhombochasm”, a pipe-like structural zone interpreted to lie within a major fault intersection with a small mercury mine at the ground surface

Gold may have been channeled by this pipe upward, along with the mercury, as occurs at the Hollister and Midas mines.

Carlin-style gold mineralization present would lie at greater depths. Rimrock appears to have Carlin-age domal structures, some of which contain Carlin-style gold deposits along the Carlin Trend. Domed anticlinal Paleozoic rocks actually crop out at the surface, at Ivanhoe Creek and along the west side of the Rimrock property.

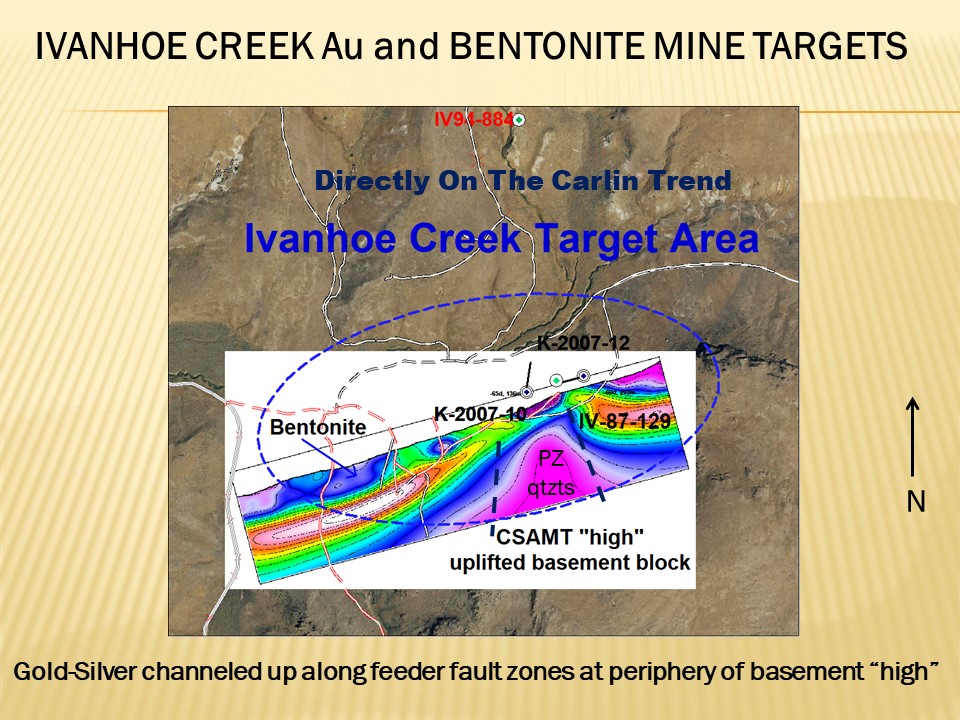

A comprehensive geophysical survey (gravity, magnetics, and CSAMT) was conducted, and five shallow core holes were drilled into the Ivanhoe Creek target area in 2007 by Kent Exploration, in search of Midas and Carlin-style gold mineralization

Two of these holes – numbers 10 and 12 – were shallow, angled holes that discovered high level, silver-enriched Midas-style mineralization in domed up older quartzitic rocks. One hole was drilled in 1988 into Ivanhoe Creek by Touchstone Resources.

It is interpreted that gold mineralization could be present below this gold rich zone. High tungsten (W) values occurred in the silver-gold mineralization, suggesting a W-tactite zone around a granitic body at depth. This and the domal uplift are very favorable for the presence of Carlin-style gold mineralization at depth.

These two main targets at Rimrock have never been properly tested by drilling. The Company believes that Rimrock offers good potential to hold a large, high-grade, underground-mineable Midas-type gold-silver deposit. If Carlin-style gold mineralization is present, the targets will be much larger. The topography is suitable for underground mine ramp development, and the Midas and Hollister mine-mill complexes are situated nearby, and may be available for custom milling of non-Hecla ores.

Consultants to the Company conducted new geologic mapping and geochemical sampling and assaying of Rimrock in 2013, to further evaluate the gold-silver potential of the property. Seventeen new samples were taken and analyzed, to augment the geochemical database. These new detailed sample data show anomalous gold, silver, arsenic, mercury, selenium, and thallium, which are associated with Midas and Carlin-style gold-silver deposits along some major fault structures on the property; all of which are very favorable signs. The principal epithermal gold-silver target was validated and even augmented by the new geologic mapping and sampling. Geological conditions suggest the possibility for the presence of a multi-million ounce epithermal gold-silver deposit at Rimrock, and anomalously elevated Carlin-only trace element thallium was found in three samples. The depth to possible Carlin-style gold mineralization has not been defined by this work, but a geochemical leakage-upward zone of thallium, tungsten and arsenic may be present.

New Induced Polarization geophysics is contemplated on the property in order to better define any Midas- and Carlin-style gold-silver potentials. The possibility of the latter being present in an untested domal structure is quite exciting. The epithermal Midas-Hollister type gold-silver targets at Dilation and Ivanhoe Creek likely would occur at 300-400 metre depths below the surface. Overall, the Rimrock property offers very interesting targets for new gold-silver mineralization.

Robert Rosner, CAT’s Chairman and CEO, stated, “Nevada is known for its great mineral potential and world class deposits. We are pleased to be gaining access to such a strategically well located property with previous results such as these, and look forward to completing additional work to unlock its full potential.”

The Company anticipates completing a 43-101 Technical Report on the Rimrock Gold property by the end of November.

Key Transaction Details

The Company signed a binding and definitive share purchase agreement (the Share Purchase Agreement”) dated November 2, 2020 to acquire all of the outstanding shares (the “Acquisition”) of the Vendor from its shareholders in exchange for 25,000,000 CAT common shares (“CAT Shares”). The CAT Shares are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation. In addition, the Company is required to incur $620,000 in exploration or expenditures related to the Property over a 4-year period, of which $210,000 must be spent within the first 12 months, after which the Company will have earned a 51% interest in Rimrock. There are no annual minimum expenditures per year during the remainder of the term regarding the remaining $410,000 of Expenditures. The Company will earn a 7.25% interest in the property for every $102,500 spent, until such time as the 80% participating interest in Rimrock is earned. The Company will grant the Vendors a 2% Net Smelter Royalty (“NSR”) on the property, subject to an agreement that each 1% of the NSR on select claims could be repurchased by the Company for an amount of USD$1,000,000.

The Acquisition is expected to close on or about November 16, 2020 and may be subject to regulatory and stock exchange approvals.

Board Appointment

The Company also announces that Mr. Julien Davy, P.Geo., M.Sc. & MBA has been appointed to the Company’s Board of Directors. Mr. Davy replaces Ms. Diane Mann, who has resigned from the board, as an independent director.

Mr. Davy is a Member of the OGQ and Qualified Person (QP) according to National Instrument 43-101. Mr. Davy began his career as an exploration geologist in the summer of 1996. Since then, he has assessed numerous projects at the exploration or more advanced stages in Canada and abroad, and has been involved in the acquisition and mining investment aspects. He has a Master’s from Université du Québec à Montréal and an MBA from HEC in Montréal, and is currently the President & CEO of Tarku Resources Ltd. He has held the position of President at Stria Lithium and Senior Exploration Geologist at Osisko Mining Corporation Canada, and was an investment consultant for SIDEX s.e.c. of Montréal. Mr. Davy also worked for NioGold Mining Corporation in Val-d’Or, Hecla Mining in Venezuela, Cambior Exploration Canada, Anglo-American Exploration, and the Ministry of Natural Resources of Québec. In 2015, he co-founded, with Benoit Lafrance, Eureka Exploration – a private exploration company – which was sold to Tarku Resources in June 2017. Mr. Davy is also a member of the OGQ and Qualified Person (QP) according to National Instrument 43-101.

The Board of Directors wishes to thank Ms. Mann for her service and contribution as a Director and her continued support as the Company moves forward to the next phase of its growth and evolution.

Mr. Richard R. Redfern, C.P.G. No. 10717), is the qualified person as defined by National Instrument 43-101 who has examined and reviewed the 2009 NI 43-101 report and geological information available from public sources related to the property, and is responsible for approving the technical contents of this press release. The Qualified Person has not completed sufficient work to verify the historic information on the Property, particularly in regard to the neighbouring Hollister Au-Ag mine deposit.

About CAT Strategic Metals Corporation:

CAT Strategic Metals’ strategy is to acquire and advance property interests located in mineral districts proven to have world class potential, primarily for gold and copper. CAT’s Burntland Project is focused on the exploration and development of several targets located Northeast of Saint Quentin in the county of Restigouche, New Brunswick, Canada. CAT’s shares trade on the Canadian Securities Exchange (CSE) under the trading symbol “CAT”, and on the Frankfurt Stock Exchange under the symbol “8CH”.

ON BEHALF OF THE BOARD

Robert Rosner

Chairman, President & CEO

Further information regarding the Company can be found on SEDAR at www.SEDAR.com, by visiting the Company’s website www.catstrategic.com or by contacting the Company directly at (604) 674-3145.

This news release may contain forward–looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Particular risks applicable to this press release include risks associated with planned production, including the ability of the company to achieve its targeted exploration outline due to regulatory, technical or economic factors. In addition, there are risks associated with estimates of resources, and there is no guarantee that a resource will be found or have demonstrated economic viability as necessary to be classified as a reserve. There is no guarantee that additional exploration work will result in significant increases to resource estimates

Neither Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour